China - Lithium Carbonate - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingChina Is Unlikely to Tap into Afghanistan’s Resources to Strengthen Its Position in the Global Lithium Market

IndexBox has just published a new report: 'China - Lithium Carbonate - Market Analysis, Forecast, Size, Trends and Insights'. Here is a summary of the report's key findings.

Although China is the second-largest importer of lithium carbonate in the world, it dominates globally in exports for lithium oxide and lithium hydroxide. With moderate lithium deposits, the country will need to find ways to expand its resource reserves to support the rapid development of its electric car and electronics industries. It is widely viewed that China will construct lithium mining facilities in Afghanistan, but this is very unlikely in the near future due to the difficult military and political situation there.

Key Trends and Insights

China remains the second-largest importer of lithium carbonate worldwide but dominates globally in lithium oxide and hydroxide exports. According to IndexBox, in 2020, China's market share consisted of 57K tons or 67% of worldwide exports. South Korea and Japan were the main importers of Chinese lithium.

Lithium production in China grew from 10.8K tons of lithium content in 2019 to 14K tons in 2020. According to USGS estimates, China stands in fourth place globally for lithium reserves (1.5M tons of lithium content), behind Chile (9.2M tons), Australia (4.7M tons) and Argentina (1.9 M tons).

The rapidly developing electric car and electronics industries in China will require enlarging their resource reserves to meet production needs. Alternative methods to increase their mineral reserves could include expanding domestic excavation, building mining facilities abroad or expanding lithium imports.

Recently in China, there have been discussions about creating a mining facility in Afghanistan for rare earth metals to provide one means of expanding their resource reserves. Implementation of such a project in the near future is highly unlikely, mostly due to the difficult military and political situation in the country. Mes Aynak in Afghanistan, one of the world's largest copper deposits, serves as a precedent, where China invested in mining operations. In 2008, the Chinese Company MCC-JCL Aynak Minerals (MJAM) received a permit to rent and develop the ore, but to this day they haven't begun to extract nor smelt the ore. Currently, the project remains within an exploration phase. The main reasons for the facility's stalled construction are threats of armed conflict in Afghanistan and a shortage of necessary resources such as coal and phosphate.

There are no reliable sources of data about Afghanistan's lithium deposits. According to estimates from the Afghanistan Ministry of Mines and Petroleum, there are 1.4M metric tons of rare earth elements in the country. There is no open-source information detailing whether those minerals are accessible for the extraction or whether they are contaminated by radioactive elements. At the moment, there are no active mining operations for lithium in Afghanistan. The mining industry is significantly under-developed there, and due to a low GDP, the only method to stimulate growth is foreign investment.

Currently, the Belt and Road Initiative should enable China to strengthen its leading position in the global lithium export market. The initiative's main goal is to construct a unified large market among countries in Asia Pacific, Africa as well as Central and Eastern Europe. It should help China increase exports of lithium as well as increase imports of crude ores when necessary. Within the Belt and Road Initiative, China has invested in transport and logistics infrastructure in Sri Lanka, Pakistan, Bangladesh, Nepal and Afghanistan.

Lithium Carbonate Imports into China

In value terms, lithium carbonate imports expanded sharply by +8.5% to $261M (IndexBox estimates) in 2020. In physical terms, lithium carbonate imports into China reached 50K last year.

Chile (37K tons) constituted the largest lithium carbonate supplier to China, with a 74% share of total imports in 2020. Moreover, lithium carbonate imports from Chile exceeded the figures recorded by the second-largest supplier, Argentina (13K tons), threefold.

The average lithium carbonate import price stood at $5,208 per ton in 2020, falling by -36.5% against the previous year. Average prices varied noticeably amongst the major supplying countries. In 2020, the country with the highest price was Argentina ($5,922 per ton), while the price for Chile stood at $4,889 per ton. In 2020, the most notable rate of growth in terms of prices was attained by Argentina.

Lithium Oxide and Hydroxide Exports from China

In value terms, South Korea ($357M) and Japan ($313M) constituted the largest markets for lithium oxide and hydroxide exported from China worldwide.

Lithium oxide and hydroxide exports from China skyrocketed to 57K tons in 2020, picking up by +16% against the previous year. In value terms, lithium oxide and hydroxide exports declined slightly to $688M (IndexBox estimates) in 2020.

South Korea (29K tons) and Japan (26K tons) were the main destinations of lithium oxide and hydroxide exports from China. In 2020, the most notable growth rate regarding the volume of shipments, amongst the main countries of destination, was attained by South Korea (+68% y-o-y).

The average lithium oxide and hydroxide export price stood at $12,120 per ton in 2020, which is down by -15.2% against the previous year. Average prices varied noticeably for the major overseas markets. In 2020, the country with the highest price was South Korea ($12,491 per ton), while the average price for exports to Japan totaled $11,968 per ton. In 2020, the most notable growth rate in terms of prices was recorded for supplies to Japan.

Join Us at HANNOVER MESSE 2024

Don’t miss your chance to connect with us directly. Schedule a personal meeting to dive deeper into how solutions.

Hall 002, Stand C10. 22 - 26 April 2024 | Hannover, Germany

This report provides an in-depth analysis of the lithium carbonate market in China. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

Country coverage:

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Trade (exports and imports) in China

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- MARKET STRUCTURE

- TRADE BALANCE

- PER CAPITA CONSUMPTION

- MARKET FORECAST TO 2030

-

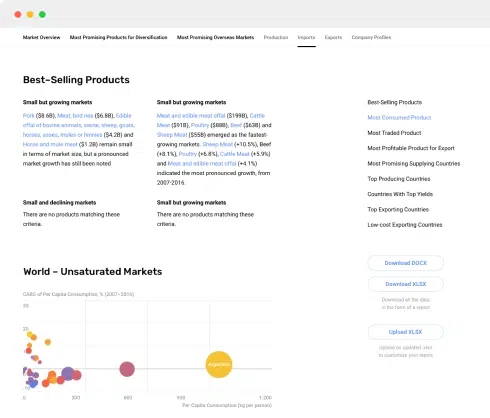

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

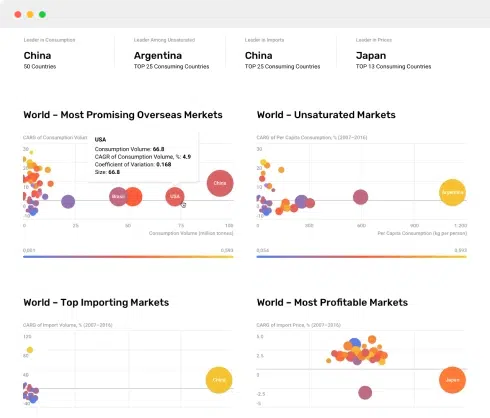

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

8. IMPORTS

The Largest Import Supplying Countries

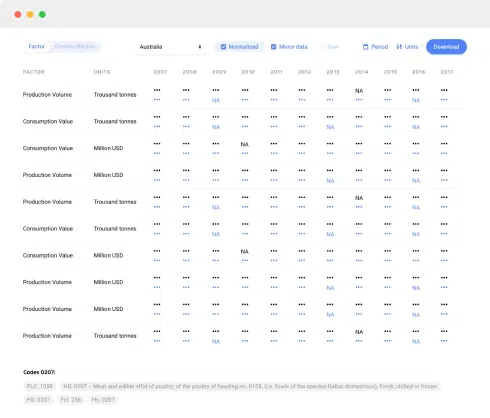

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Destinations for Exports

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption In 2012-2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Market Structure – Domestic Supply vs. Imports, In Physical Terms, 2012-2023

- Market Structure – Domestic Supply vs. Imports, In Value Terms, 2012-2023

- Trade Balance, In Physical Terms, 2012-2023

- Trade Balance, In Value Terms, 2012-2023

- Per Capita Consumption, 2012-2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023